KYC Checks – The Bouncer of the Digital World

Picture this: you’re waiting in line outside a popular club, hoping to get in and dance the night away. But before you can even make it to the door, you’re stopped by a towering bouncer who demands to see your ID. You begrudgingly hand it over, knowing that without it, you won’t be allowed inside.

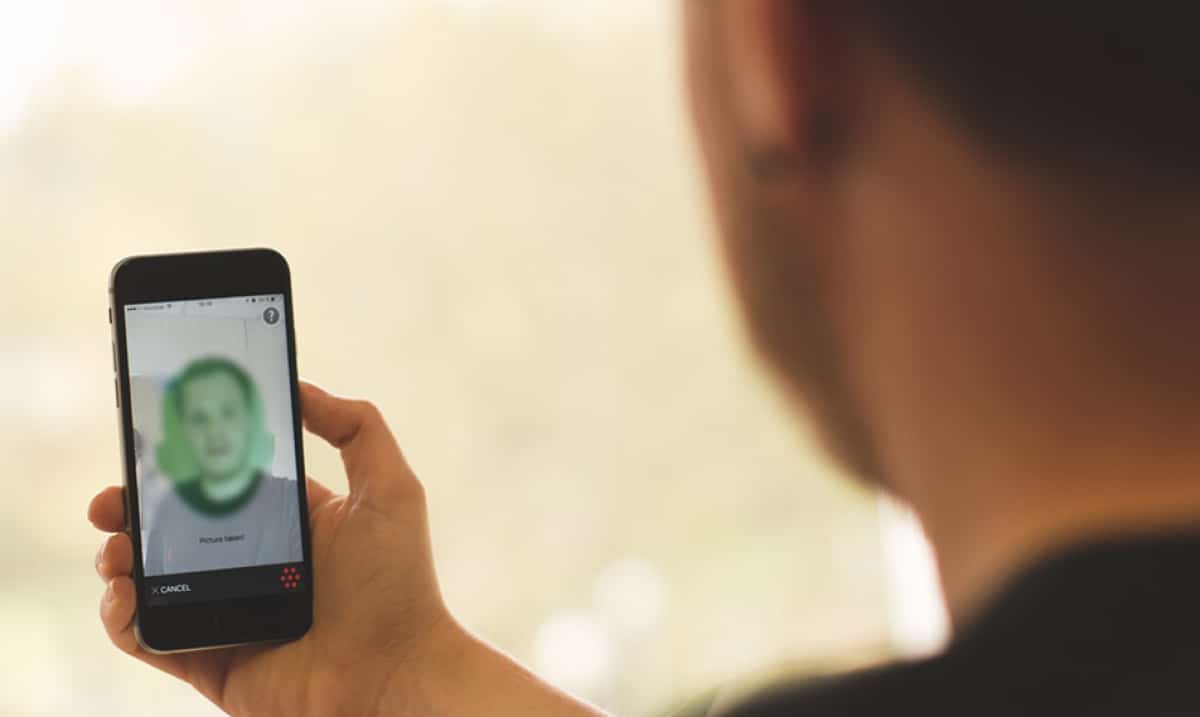

Now, imagine that same scenario, but instead of a nightclub, you’re trying to make a financial transaction online. The bouncer? That’s KYC (Know Your Customer) checks.

Just like a bouncer at a club, KYC checks are designed to keep out the riff-raff and prevent fraudulent activity. They require businesses to verify the identity of their customers and ensure that transactions are legitimate.

But while a bouncer might be intimidating and unapproachable, KYC checks can actually provide several benefits for both businesses and customers.

KYC checks are the ultimate wingman

Just like a wingman at a club who vouches for your character and helps you get inside, KYC checks can help businesses build trust with their customers. By verifying the identity of customers and ensuring that transactions are legitimate, businesses can create a more transparent environment that fosters trust.

This can be especially important for businesses that operate in industries that are traditionally associated with high levels of risk or suspicion. By implementing KYC checks, businesses can reassure their customers that they’re operating in a safe and secure environment.

KYC checks are the ultimate party planner

Imagine you’re planning a party and you have no idea who’s going to show up. Will it be a group of rowdy college students or a more refined crowd? Without knowing your guests, it’s impossible to plan a successful event.

The same goes for businesses – without knowing their customers, it’s impossible to provide personalized and targeted services. KYC checks can help businesses collect and analyze customer information, allowing them to tailor their products and services to better meet the needs of their customers.

KYC checks are the ultimate bouncer

Just like a bouncer at a club who prevents unruly patrons from causing trouble, KYC checks can help businesses prevent fraudulent activity and manage risk. By verifying the identity of customers and conducting risk assessments, businesses can identify potential threats and take action to prevent fraudulent activity.

This can be especially important for businesses that operate in industries that are frequently targeted by fraudsters, such as financial services or e-commerce. By implementing robust KYC checks, businesses can reduce their exposure to fraud and protect their reputation.

In conclusion, KYC checks might seem like the bouncer of the digital world, but they provide several benefits for both businesses and customers. From building trust and transparency to preventing fraud and managing risk, KYC checks are the ultimate wingman, party planner, and bouncer. So the next time you’re asked to show your ID, remember that KYC checks are just trying to keep the party safe and secure.